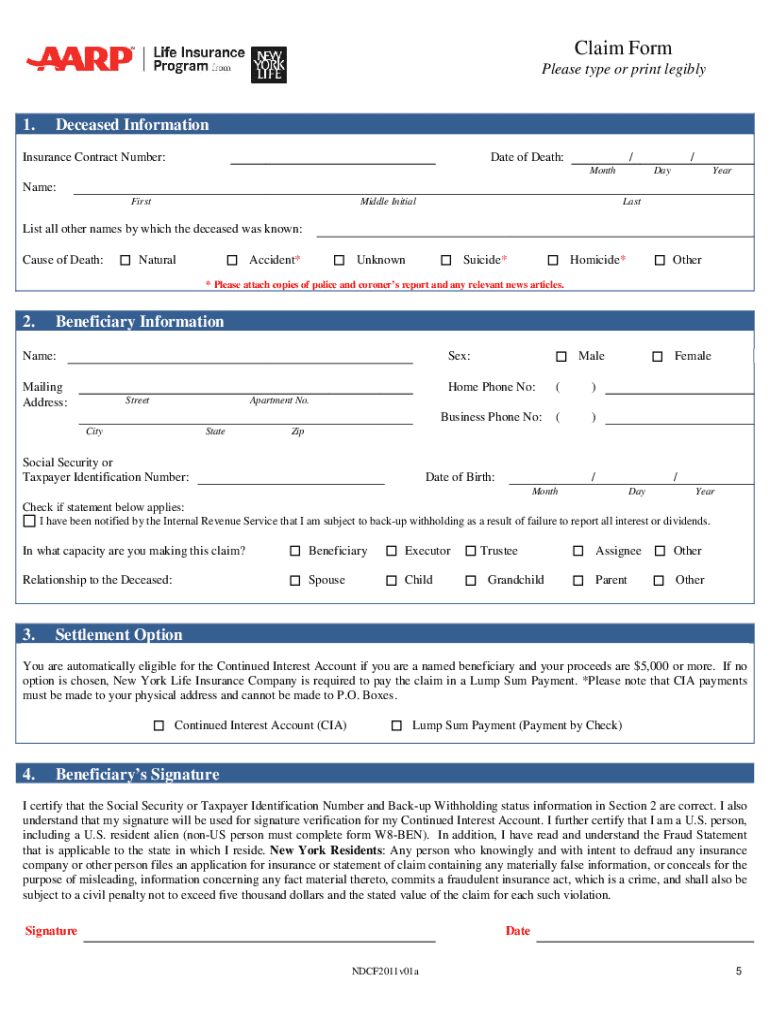

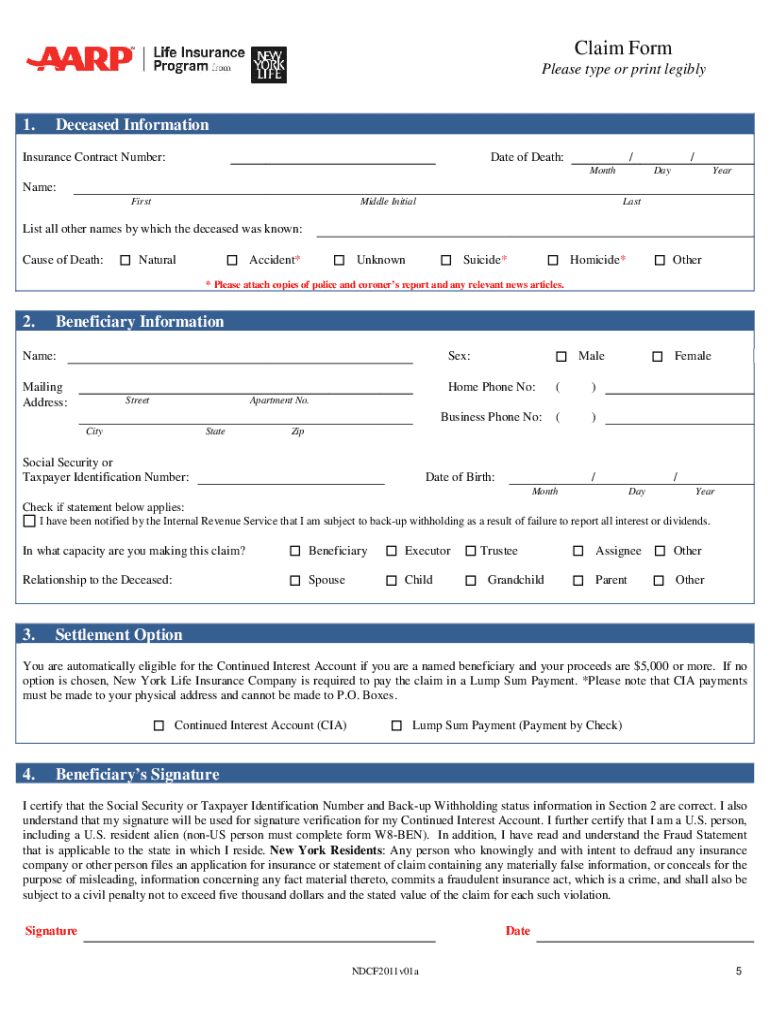

NDCFv01a 2011-2024 free printable template

Get, Create, Make and Sign

How to edit aarp funeral insurance online

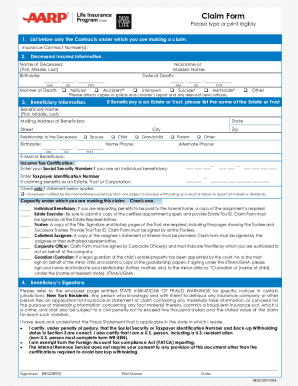

How to fill out aarp funeral insurance form

How to fill out AARP New York Life:

Who needs AARP New York Life:

Video instructions and help with filling out and completing aarp funeral insurance

Instructions and Help about life aarp claim form

Greetings out there it's David do for that buy life insurance for burial dot-com and chances are you're watching this video today because you're doing some kind of research to find out more about AARP life insurance policy and the purpose of this video is to give you some straightforward information on how AARP life insurance policy works the most common that being that comes through the mail, and they'll also give you some of the fine print that may be hard to come across upon your own reading of it so that you'll be much better educated on how the plans work, so you can make the determination of AARP life insurance policy is right for you or if something else would be a better option so AARP partners with New York Life Insurance, and they usually lead with a product either on television or through the mail called group level term insurance and so the key thing with how these plans work is that term insurance is the term is the key word you have to be aware of and understand entirely how it means, so term is short for terminating what that means is that yes if you buy a term plan through AARP that plan will terminate at age 80 that's right you can buy a plan and pay on it for years outlive it, and now you don't have any coverage so obviously if you're looking for a plan that's going to pay for your final expenses you have a big problem on your hands what if you outlived the term insurance product you may not have it when you need it now what good is a policy to pay for your burial and final expenses and that kind of thing if it's not there when you need it and this is the reason why I sit down with people and have for the past five years I have over a thousand five hundred clients to have their insurance with me this is why we sit down, and I show this than this information to them, so they can see it for themselves because a lot of these plans that come through the mail AARP plans not the only one there's also stuff on TV as well it's just not well-suited for the people buying it people are like the idea of a brand name they're all comfortable with AARP has been around for a while but a lot of the times when the onion layers peeled back it's a plan that just is not in your best interest what most people want is what's called a whole life insurance plan whole life insurance is a design they never have price increases it's locked in from the first day the coverage is designed never to cancel because of age or health, so you can't be cancelled like an AARP term policy and if all else qualifies you the goal is to get you the third benefit fully covered 100% from the first day it's not always the case but many people even with health use like diabetes cancer heart history even COPD and that kind of thing can qualify with certain companies for 100% first day coverage the key to getting the access to the best plans out there the best whole life insurance plans is to deal with someone like me a broker I represent multiple companies what I tend to do...

Fill nylaarp claim : Try Risk Free

People Also Ask about aarp funeral insurance

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your aarp funeral insurance form online with pdfFiller!

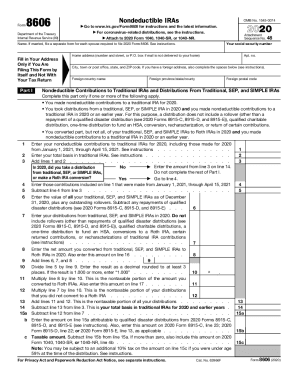

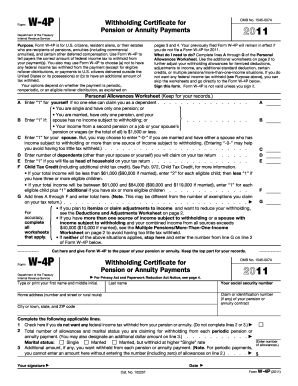

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.